What is a Health Savings Account?

A Health Savings Account, or HSA, is exactly what the name implies: a savings account established to help pay for qualified medical expenses. Savings roll over year after year, so your unused funds are available to pay health expenses even during retirement. An HSA is similar to an Individual Retirement Account (IRA) - you open your HSA and you own it. So, whether you change jobs or become self-employed, your account stays with you -- it is fully portable.

Who is eligible for an HSA?

An eligible individual is anyone who:

- Participates in a high-deductible health plan (HDHP)

- Does not have coverage through an additional health plan that is not an HDHP

- Is not enrolled for Medicare or receiving VA Benefits

- May not be claimed as a dependent on another person's tax return

What is a High-Deductible Health Plan?

This is your health insurance plan. HDHPs usually have lower premiums and higher annual deductibles than traditional health insurance. There is also a limit placed on the total out-of-pocket expenses for an individual or family each year. Individuals/employees must be enrolled in an eligible HDHP before they can open an HSA. Ask your insurance provider if your plan qualifies.

What are the tax advantages of an HSA?

- Contributions by individuals are tax-deductible from your adjusted gross income.

- Contributions you make through your employer may be deducted from your gross pay. That way you won't pay state or federal taxes on money going into your HSA.

- Funds may be used to pay for qualified medical expenses through retirement.

- Those funds continue to grow tax-free.

HOW IT WORKS

What happens to my unused funds at year's end?

Your unused funds, plus your earned interest, roll over year after year. This means your money stays with you and is yours to use in years to come.

Who owns the HSA?

You do. It is a personal, portable account that remains yours even if you change jobs or are no longer enrolled in an HDHP.

Can I have an HSA in addition to an IRA or other qualified retirement plan?

Yes. Although similar in the way they operate, an HSA is not an IRA.

What is the difference between health care flexible spending accounts (FSAs) and HSAs?

With both HSAs and FSAs you can pay for qualified expenses with pre-tax dollars. However, whereas your FSA money left unspent at the end of the year is forfeited, your HSA balance simply rolls over from year to year. If you are eligible for a HSA, you may have a limited use FSA only-to be used for dental and vision expenses only.

Can I have an HSA even though I have accident, short-term disability, or illness-specific insurance?

You (and your spouse, if you have family coverage) can have additional insurance that provides benefits only for the following items:

- A specific disease or illness.

- Liabilities incurred under workers' compensation laws, tort liabilities, or liabilities related to ownership or use of property.

- A fixed amount per day (or other period) of hospitalization.

You can also have coverage (whether provided through insurance or otherwise) for the following items.

- Accidents.

- Disability.

- Dental care.

- Vision care.

- Long-term care.

Plans in which substantially all of the coverage is through the above listed items are not HDHPs. For example, if your plan provides coverage substantially all of which is for a specific disease or illness, the plan is not an HDHP for purposes of establishing an HSA.

FUNDING

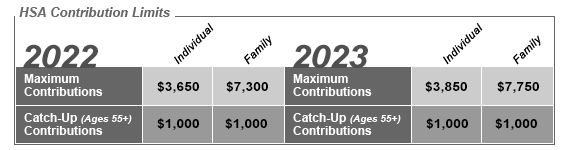

How much may be contributed to an HSA?

You and your employer can make contributions to your HSA. See chart below for the maximum contributions allowed. Persons age 55-65 can also make an additional "catch-up" contribution.

Who may contribute to my HSA?

Anyone - you, your employer or any individual - can contribute to your HSA. Contributions made by you or another individual are deductible from your gross income. Your employer's contributions are exempt from federal employment taxes (e.g., income, FICA and FUTA).

Is there a deadline for contributions?

The deadline for contributions for any given tax year is April 15 of the following year.

Can Individual Retirement Account, Health Reimbursement Account, or Flexible Spending Account funds be rolled into an HSA?

No.

USING HSA FUNDS

What is a qualified medical expense?

One of the primary benefits of an HSA is that you can pay for qualified medical expenses from your HSA account tax-free. These include most medical related expenses for you, your spouse, and dependents. View a complete list at www.irs.gov/pub/irs-pdf/p502.pdf.

Who is responsible for determining if a medical expense is qualified?

As the individual account holder, you are responsible for determining if an expense qualifies to be paid with HSA funds. Be sure to save all invoices and statements that support the eligibility of withdrawals from your HSA.

Do health insurance premiums count as "qualified medical expenses"?

Generally, no, except in the following instances:

- Qualified long-term care insurance

- COBRA health care continuation coverage

- Health care coverage while an individual is receiving unemployment compensation

Can HSA funds be used for non-medical expenses?

Non-medical distributions from an HSA are included in gross income and as such are taxed, as well as subject to a 20% penalty if withdrawn for non-medical purposes prior to age 65. Consult your tax advisor for regulations regarding distributions from HSAs.

What happens to my unused HSA funds when I die?

Like an IRA, the assets in an HSA become the property of a named beneficiary upon the accountholder's death, or go to the estate if no beneficiary is named. A spouse beneficiary can treat such assets as their own account, while a non-spouse must include them as ordinary income for taxation purposes.

What if funds are not available in my HSA when I incur a qualified medical expense?

Use another method to pay for a qualified medical expense. Then, once the money is in your HSA, you can reimburse yourself from your HSA account for whatever amount you paid for the expense.

Need Assistance?

If you have additional questions, contact Franklin Savings Bank for assistance.